PyMC BAYESIAN ANALYSIS GUIDE FOR MARKETING DATA ANALYSTS

A Comprehensive Reference for Building Reliable Models.

Document version: 1.1

Last updated: December 2025

Target audience: Marketing analysts working with website traffic, signups, conversions, sales pipeline, channels, and campaigns.

CRITICAL SUCCESS FACTORS

These three rules are non-negotiable for every PyMC analysis:

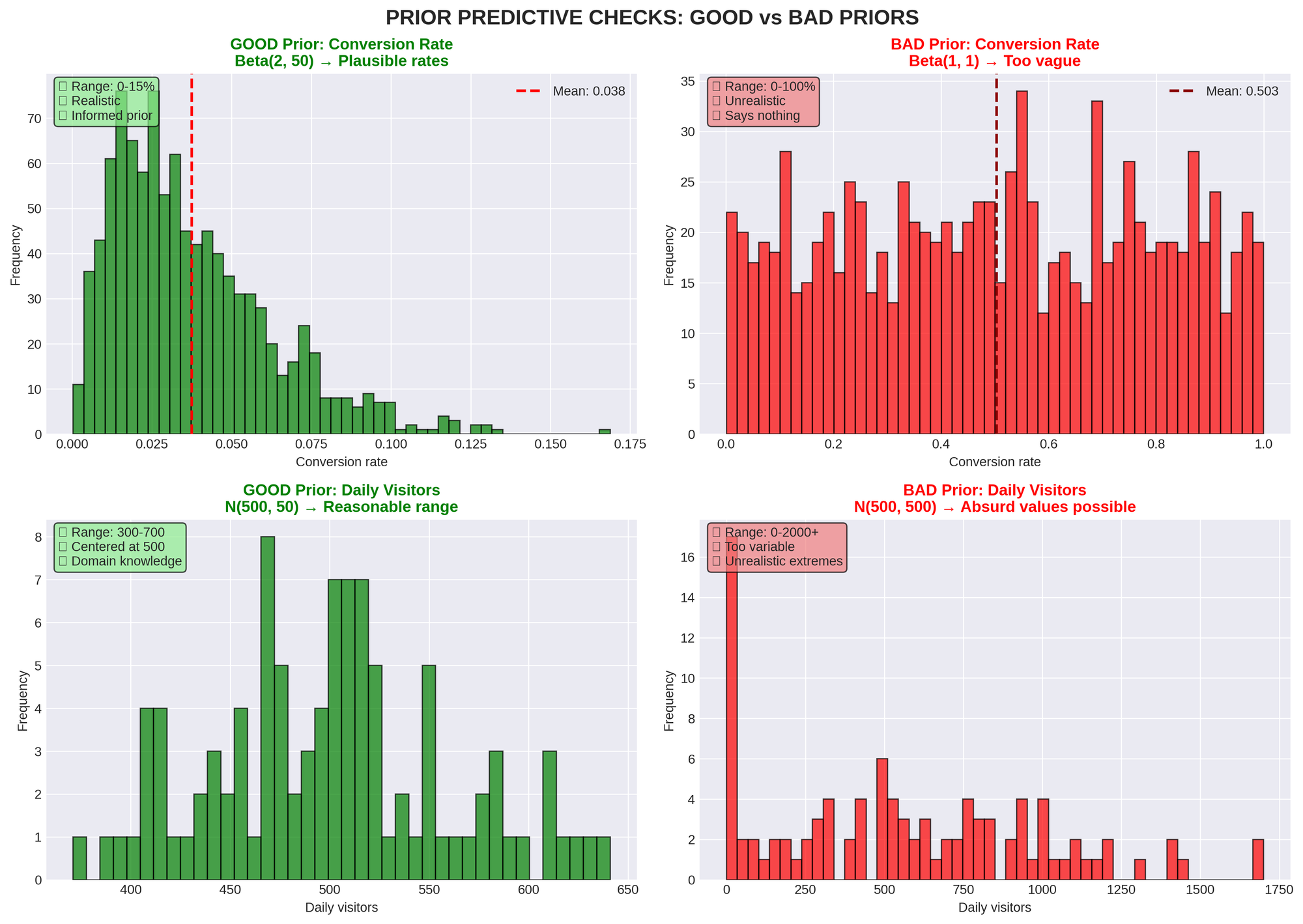

- ALWAYS check prior predictive distributions - Your model must make sense BEFORE seeing data.

- ALWAYS choose distributions matching your data constraints - Count data needs count distributions, positive data needs positive distributions.

- ALWAYS validate with posterior predictive checks - If your model cannot

reproduce observed data, it is wrong.

THE COMPLETE BAYESIAN WORKFLOW

Follow these four stages in order. No shortcuts.

STAGE 1: Design Your Model

- Understand your data structure and constraints

- Choose appropriate likelihood distributions

- Specify priors based on domain knowledge

STAGE 2: Check Priors (Prior Predictive)

- Sample from priors before seeing data

- Verify simulated values are plausible

- If you see absurd extremes, tighten your priors

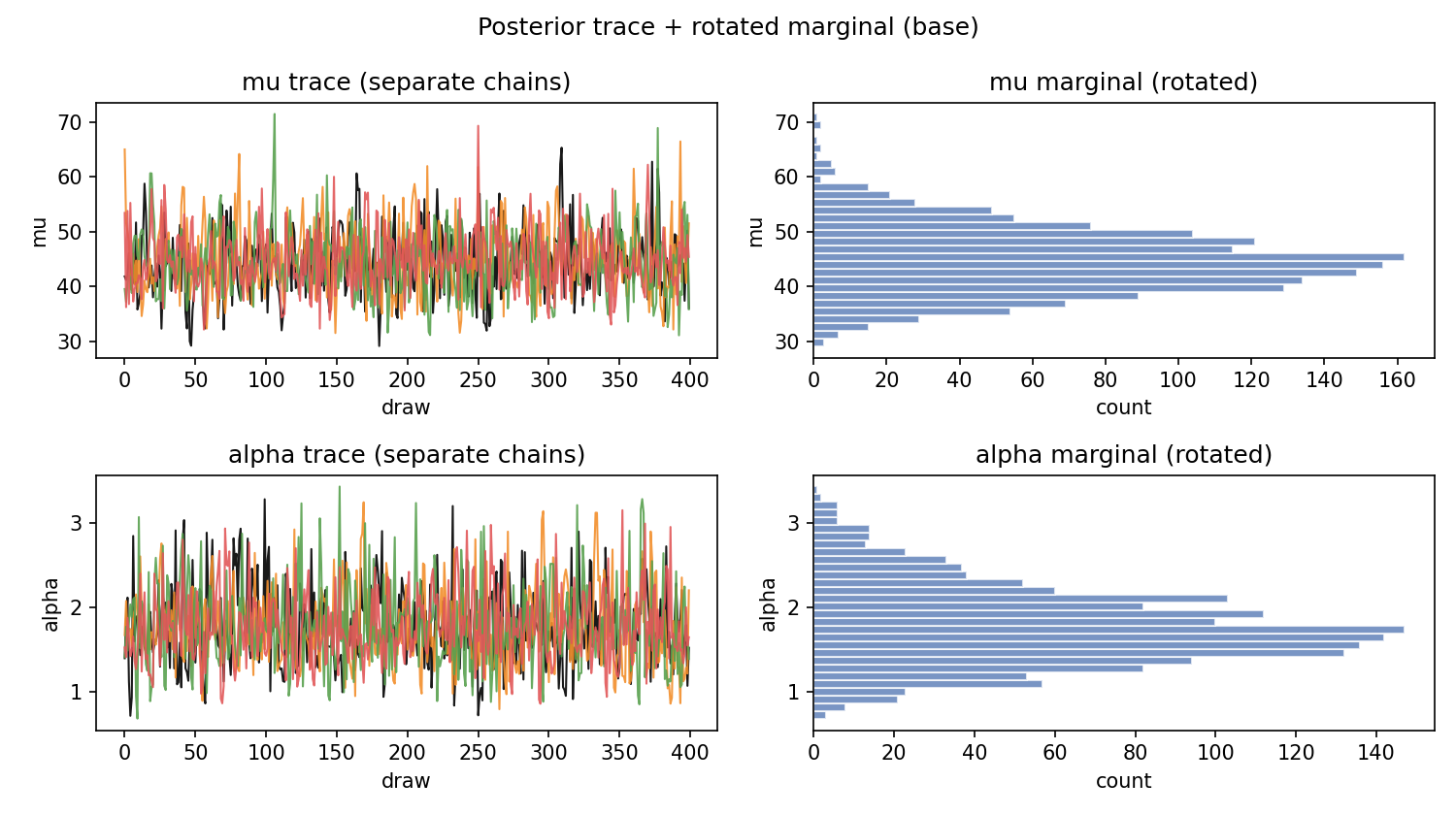

STAGE 3: Fit the Model (MCMC Sampling)

- Use sufficient draws, tuning steps, and chains

- Monitor convergence diagnostics

- Address any warnings immediately

STAGE 4: Validate Results (Posterior Predictive)

- Generate fake data from fitted model

- Compare to observed data

- If model cannot reproduce observations, it's wrong

DATA SANITY CHECK (Start Here Every Time)

Before building any model:

- EXAMINE BASIC STATISTICS

- Mean, variance, min, max

- Standard deviation and range

- Check for outliers

- VERIFY DATA PROPERTIES

- Units and any transformations

- Presence of zeros or missing values

- Data bounds and constraints

- UNDERSTAND DATA TYPE

- Is it counts (whole numbers only)?

- Is it continuous and always positive?

- Can it be negative?

- Is it bounded (0-1, percentages)?

- Is it binary (yes/no)?

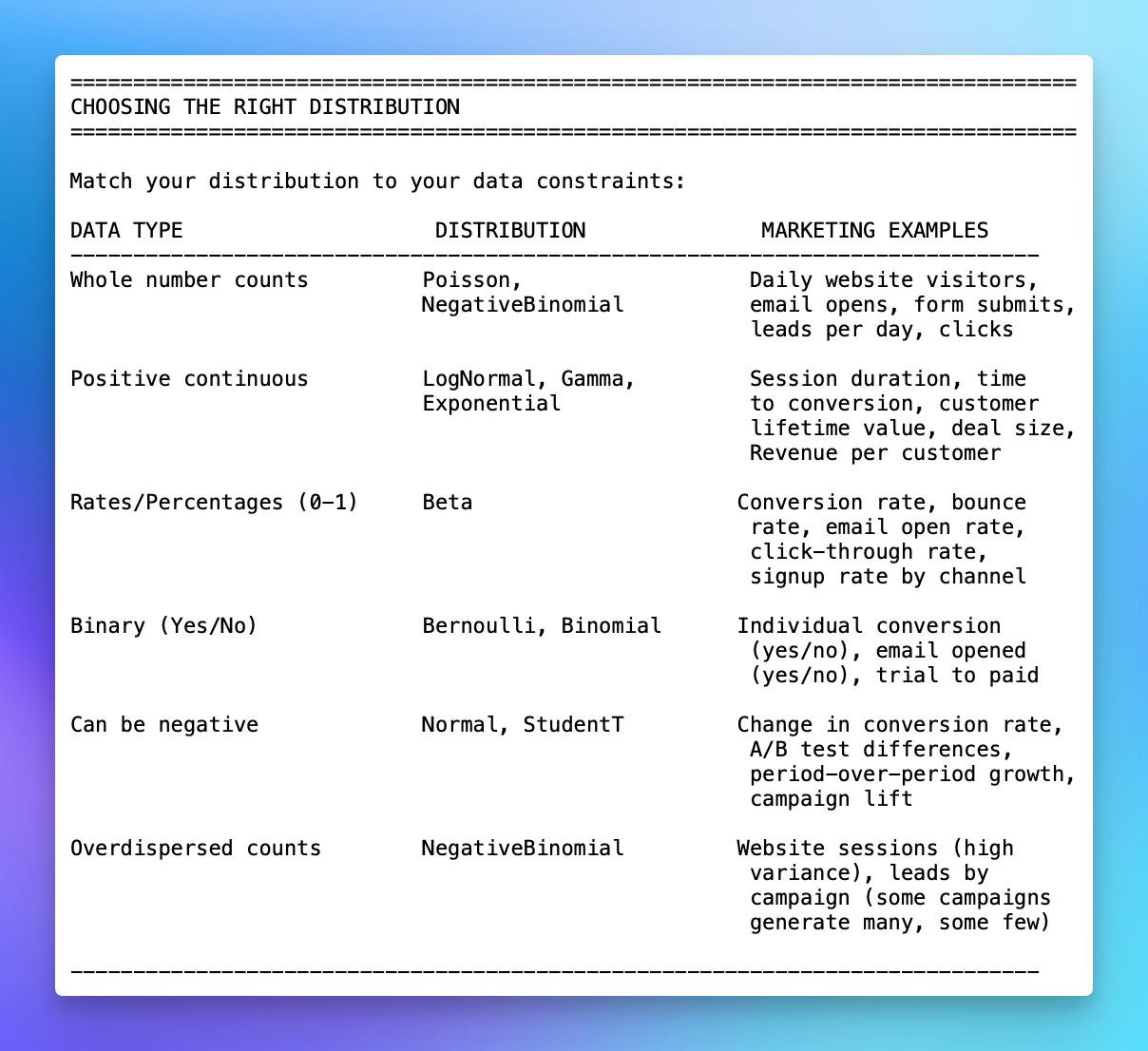

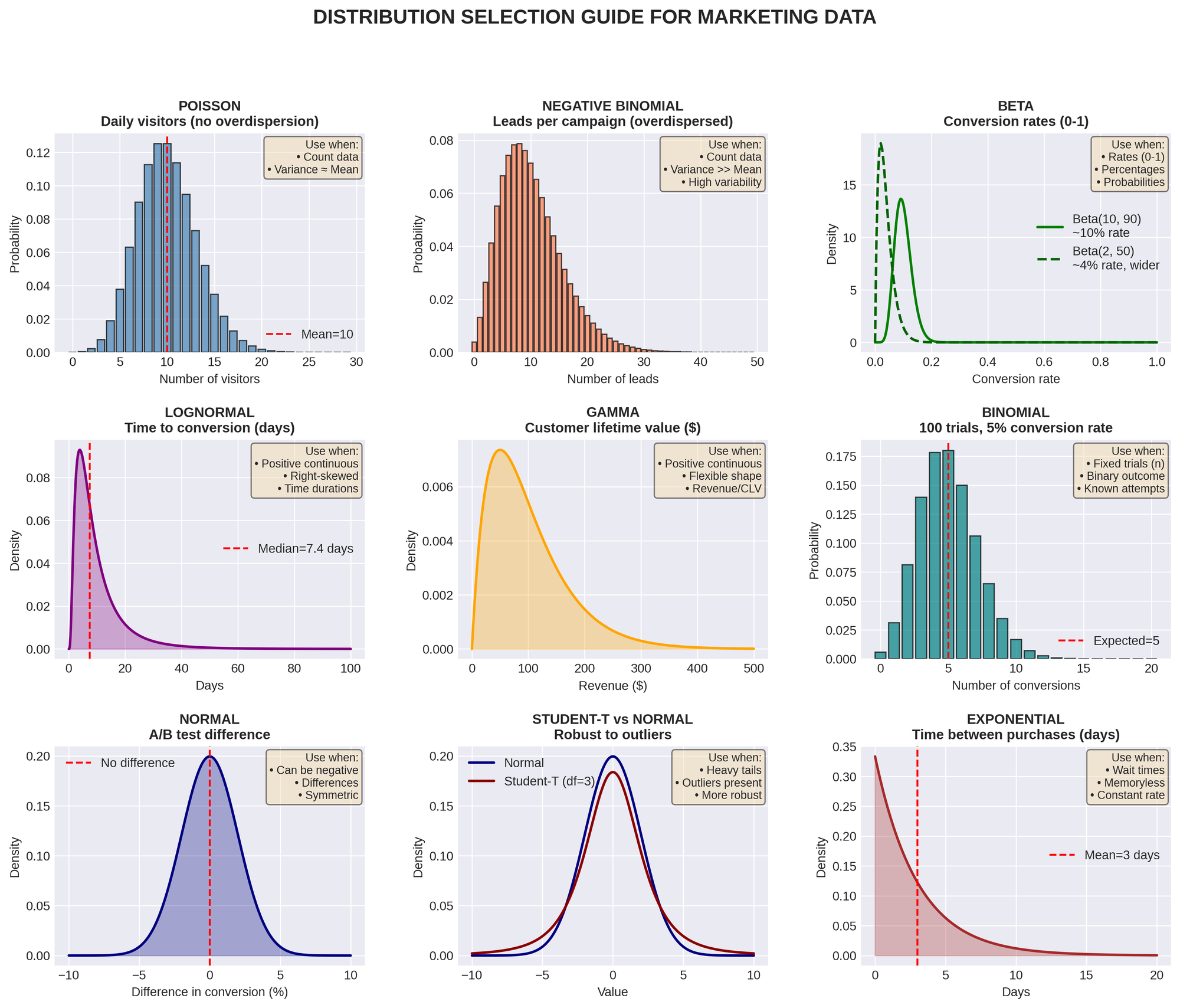

CHOOSING THE RIGHT DISTRIBUTION

Match your distribution to your data constraints:

QUICK DECISION TREE:

- Can I count it in whole numbers? → Poisson / NegativeBinomial

- Is it always positive measurement? → LogNormal / Gamma

- Is it a percentage or rate? → Beta

- Is it just yes/no? → Bernoulli / Binomial

- Can it be negative? → Normal / Student-T

MARKETING-SPECIFIC EXAMPLES:

Example 1: Daily Website Visitors

- Data: 450, 523, 389, 612, 501 visitors per day

- Type: Counts (whole numbers)

- Distribution: Poisson or NegativeBinomial

- Why NegativeBinomial? If variance >> mean (weekends vs weekdays vary a lot)

Example 2: Conversion Rate by Channel

- Data: Paid: 3.2%, Organic: 4.5%, Email: 5.1%

- Type: Percentage/rate (bounded 0-1)

- Distribution: Beta

- Prior example: Beta(2, 50) means ~4% with moderate uncertainty

Example 3: Time to First Purchase

- Data: 3.5 days, 12.1 days, 1.2 days, 45.3 days

- Type: Positive continuous (can't be negative)

- Distribution: LogNormal or Gamma

- Why LogNormal? Time data is often right-skewed

Example 4: Lead-to-Opportunity Conversion

- Data: 150 leads, 23 converted to opportunities

- Type: Binary outcomes

- Distribution: Binomial(n=150, p=?)

- Model learns: What's the conversion probability p?

Example 5: A/B Test Revenue Impact

- Data: Control mean $1,250, Treatment mean $1,310

- Type: Difference can be positive or negative

- Distribution: Normal for difference

- Goal: Is treatment > control?

COMMON PITFALLS TO AVOID

- MIS-SPECIFYING PRIORS

Bad: Using Normal(0, 1000) for a variance parameter

Good: Using HalfNormal(5) for positive-only variance

Remember: Priors must respect constraints (positive, bounded) - WRONG LIKELIHOOD FUNCTION

Bad: Using Normal distribution for count data (e.g., daily signups)

Good: Using Poisson or NegativeBinomial for counts

Remember: Match distribution to data type.

Marketing Example:

Bad: Modeling email opens (counts) with Normal distribution

Good: Modeling email opens with Poisson or NegativeBinomial - IGNORING CONVERGENCE DIAGNOSTICS

Never ignore: Divergences, high R-hat, low ESS

These mean: Your results are unreliable

Action required: Fix before interpreting results - MISINTERPRETING RESULTS

Don't: Treat credible intervals like confidence intervals

Don't: Over-interpret point estimates

Do: Report full uncertainty (credible intervals)

Do: Acknowledge subjective prior choices. Key Difference:- Credible interval: "Given model + priors, there's X% probability

parameter lies here." - Confidence interval: "In repeated sampling, X% of such intervals

contain the true parameter."

- Credible interval: "Given model + priors, there's X% probability

- INCOMPLETE POSTERIOR PREDICTIVE CHECKS

Bad: Only checking mean predictions

Good: Check entire distribution, tails, variance

Remember: Model must reproduce all features of data.

Marketing Example:

Check if your model can generate both typical days (500 visitors) AND

extreme days (2000 visitors from viral post) - FIXING VARIANCE WITHOUT JUSTIFICATION

Bad: Setting sigma to a fixed value arbitrarily

Good: Let the model learn variance from data

Exception: Only fix if you have very strong domain knowledge.

Marketing Example:

Don't assume conversion rate variance is fixed at 0.01 unless you have

strong historical evidence

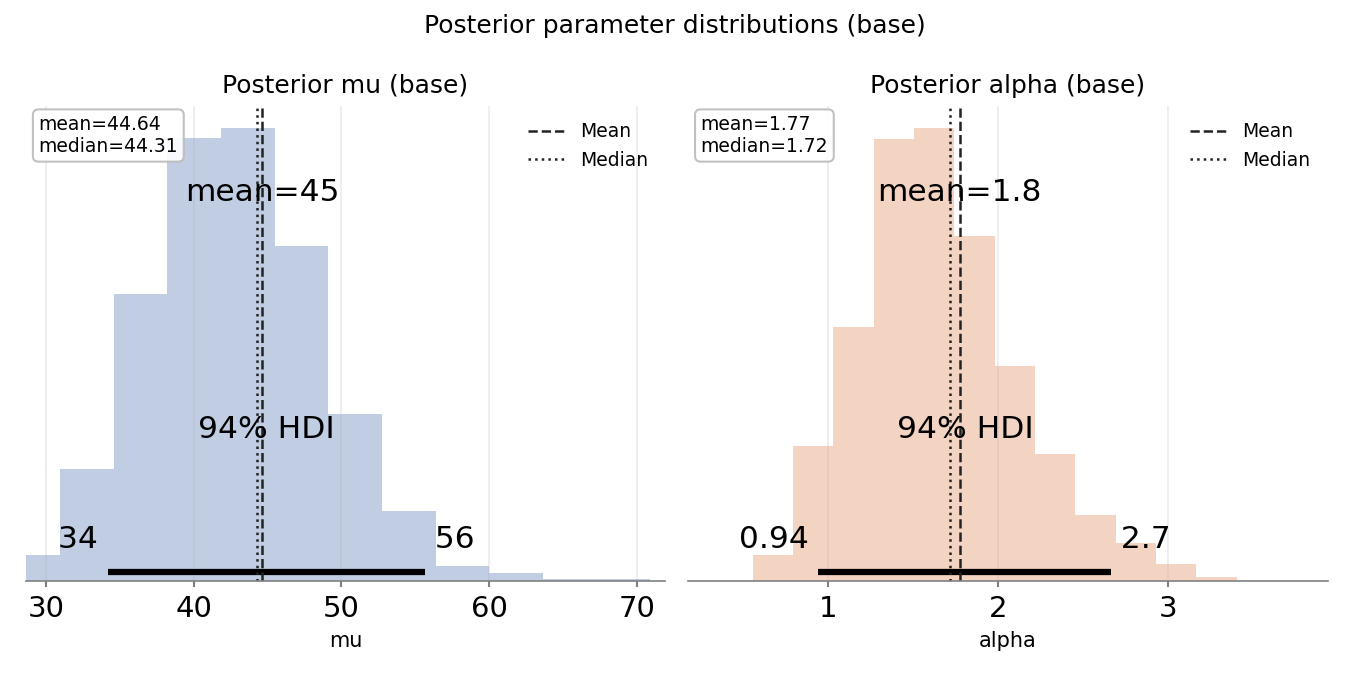

SPECIFYING PRIORS CORRECTLY

GENERAL PRINCIPLES

- RESPECT CONSTRAINTS

- Use HalfNormal, HalfCauchy, Exponential for positive-only parameters

- Use Beta for rates between 0 and 1

- Never use unbounded priors for bounded parameters

- Prefer HalfNormal / Exponential as defaults

- Use HalfCauchy only when you intentionally want very heavy tails and

you've checked prior predictive

- USE DOMAIN KNOWLEDGE

- Set realistic ranges based on subject matter expertise

- Avoid overly tight priors unless strongly justified

- Document your reasoning

Marketing Examples:

- Website conversion rate: Beta(2, 50) suggests ~4% with uncertainty

- Daily visitors: NegativeBinomial with mu=500, alpha=10 if historical

average is 500 - Email open rate: Beta(10, 90) suggests ~10% with moderate confidence

- HANDLE CORRELATION AND WEAK IDENTIFICATION

If parameters are highly correlated or weakly identified, consider

reparameterization, stronger priors, or simplifying structure - CHECK PARAMETERIZATION

Example: NegativeBinomial can be parameterized as (mu, alpha) or (n, p)- Understand what each parameter means (alpha, mu, sigma, etc.)

- Verify formulas for mean, variance, overdispersion

- Different distributions may use different parameterizations

- mu = mean, alpha = overdispersion

- Verify which parameterization your library uses!

PRIOR PREDICTIVE WORKFLOW

- Define priors

- Sample from priors (before seeing data)

- Generate simulated datasets

- Ask: "Are these values plausible?"

- If no → Adjust priors

- Repeat until priors generate reasonable data

MARKETING PRIOR EXAMPLES

Email Campaign Open Rate:

- Prior: Beta(10, 90)

- Implies: ~10% open rate with some uncertainty

- Prior predictive: Generates rates between 5-20% (reasonable)

Daily Website Visitors:

- Prior: mu ~ Normal(500, 100), alpha ~ Exponential(0.1)

- Implies: Average around 500 visitors, moderate overdispersion

- Prior predictive: Should generate days between 200-1000 visitors

Conversion Rate by Channel:

- Prior for each channel: Beta(2, 50)

- Implies: Weak prior around 4%, allows learning

- Check: Does prior generate rates between 0.01-0.15? (reasonable for most

channels)

Time to Conversion (days):

- Prior: LogNormal(mu=2, sigma=1)

- Implies: Median ~7 days (exp(2)), wide spread

- Prior predictive: Should generate times from 1 day to 100+ days

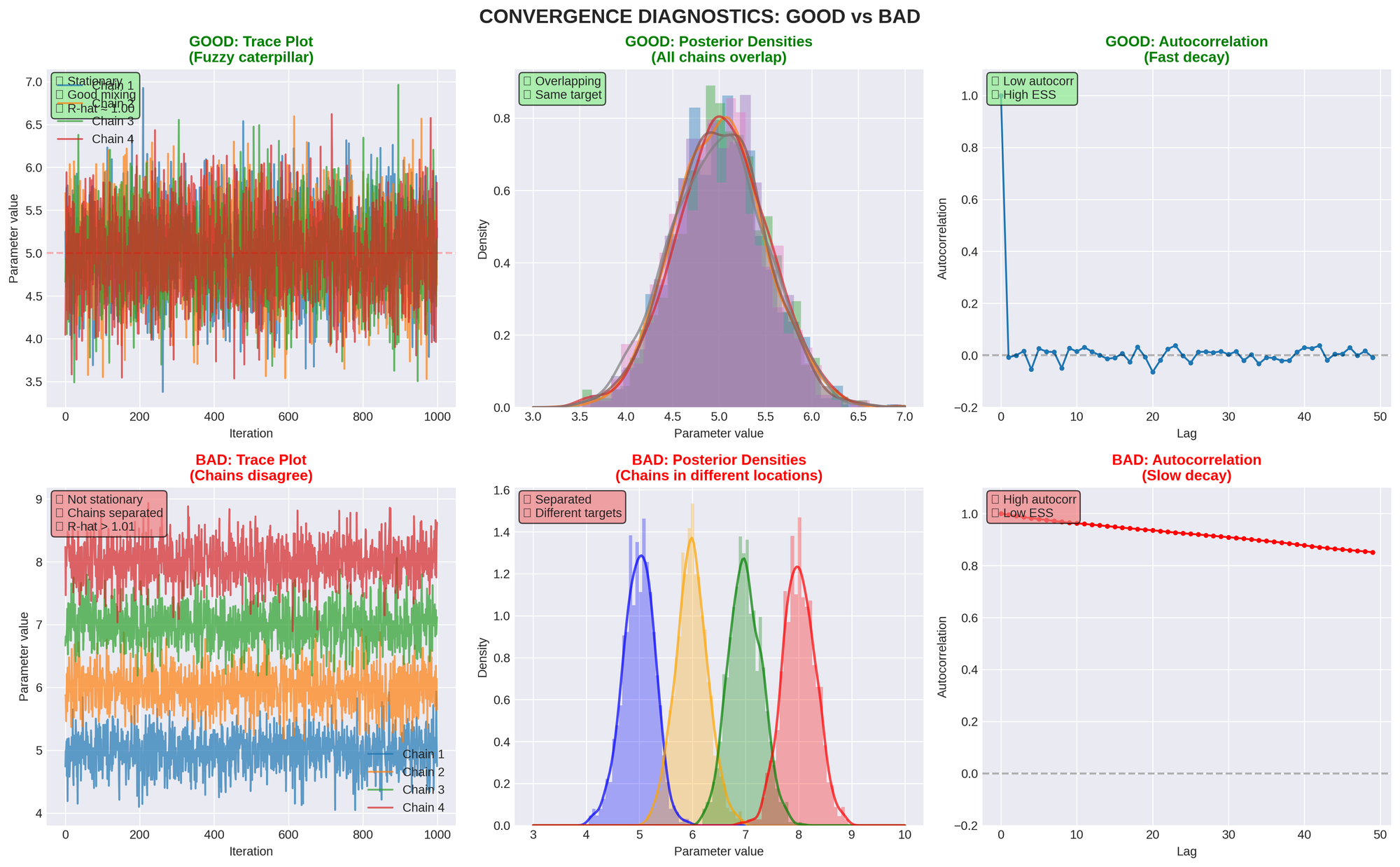

CONVERGENCE DIAGNOSTICS (Must-Check List)

- R-HAT (GELMAN-RUBIN STATISTIC)

Target: ≤ 1.01 (ideally 1.00-1.01)

Meaning: Do all chains agree on the same distribution?

If > 1.01: Chains disagree; run longer or reparameterize

Action: Increase draws/tune or fix model structure - EFFECTIVE SAMPLE SIZE (ESS)

Target: Hundreds+ for stable estimates

Meaning: How many independent samples do we have?

If < 100: Chain is sluggish, autocorrelation is high

Action: Increase draws or improve parameterization - DIVERGENCES

Target: 0 (zero divergences)

Meaning: Sampler hit trouble spots in posterior

If > 0: Sampler is missing important posterior regions

Action:- Increase target_accept (try 0.95 or 0.99)

- Reparameterize model (non-centered parameterization)

- Simplify model structure

VISUAL DIAGNOSTICS

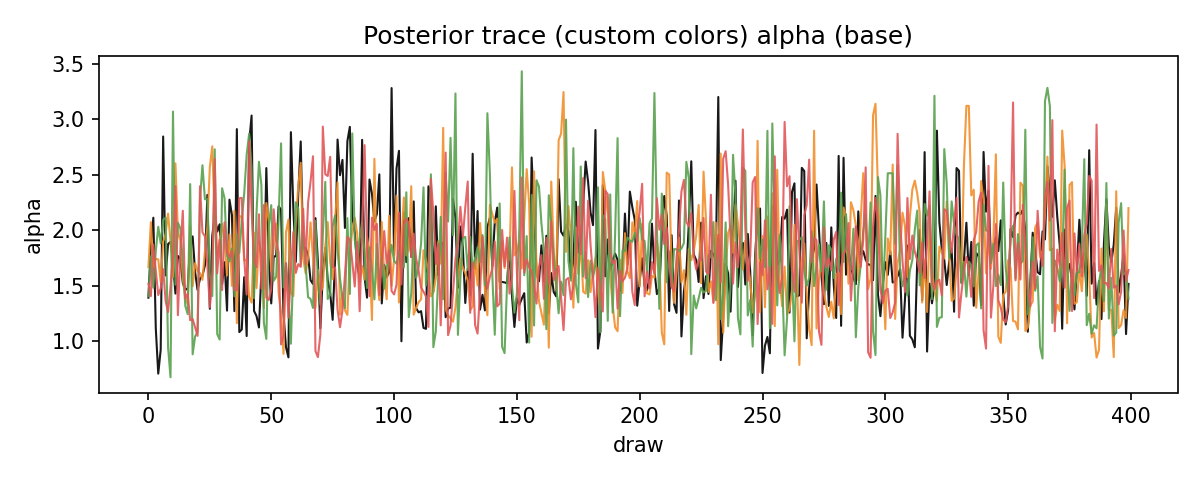

TRACE PLOTS

- Good: Chains look like "fuzzy caterpillars"

- Bad: Chains show trends, drift, or distinct bands

- Look for: Stationarity, mixing, convergence

RANK PLOTS

- Good: Uniform distribution across ranks

- Bad: Patterns or clustering in ranks

- Better than: Traditional trace plots for detecting issues

CHAIN COMPARISON (KDE PLOTS)

- Good: All chains have overlapping distributions

- Bad: Chains sit in different locations

- Indicates: Convergence problems if separated

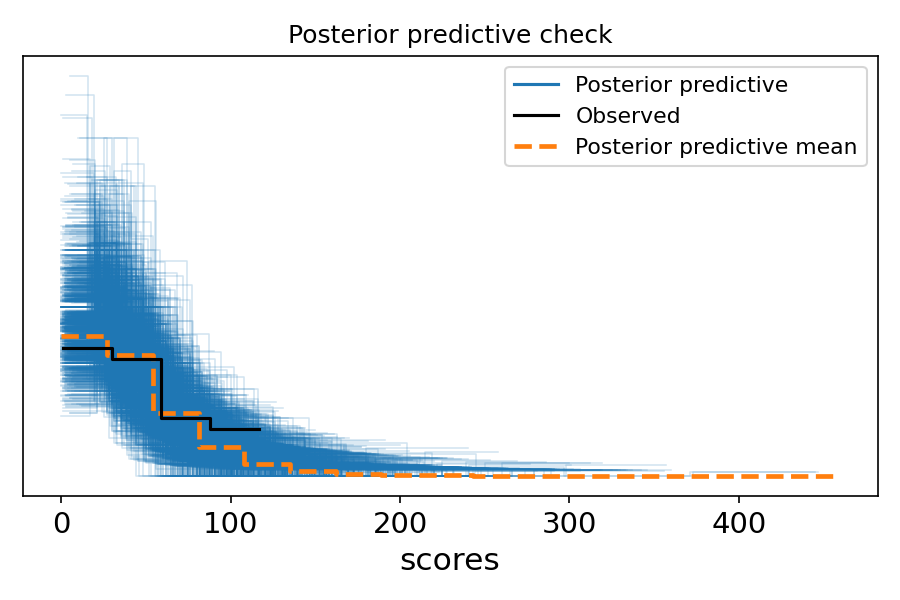

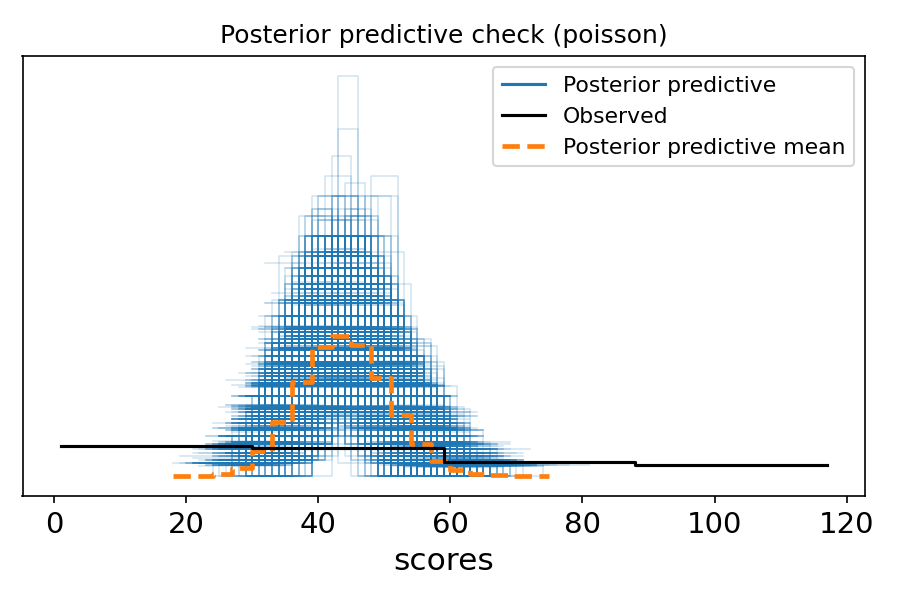

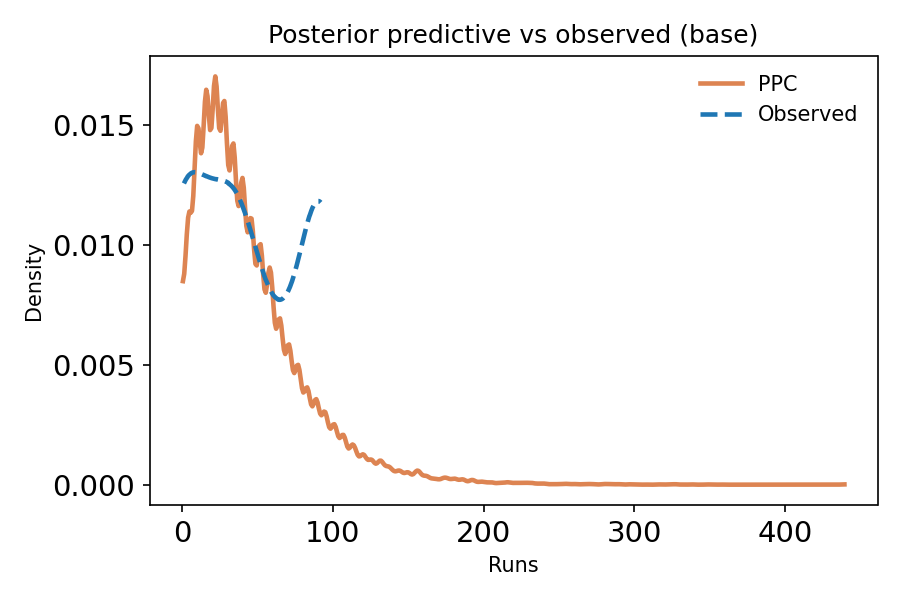

POSTERIOR PREDICTIVE CHECKS (PPC)

PURPOSE

Verify that your fitted model can reproduce the observed data.

WHAT TO CHECK

- Central tendency: Does model match observed mean/median?

- Spread: Does model capture observed variance?

- Tails: Can model generate extreme values seen in data?

- Shape: Does overall distribution match?

- Coverage: Are observed totals within predicted range?

INTERPRETATION

- Good PPC: Observed data looks typical compared to predictions

- Bad PPC: Observed data is extreme or outside predicted range

- Action if bad: Model is wrong; revise and refit

COMMON PPC FAILURES

- Under-fit tails: Use heavier-tailed distribution (e.g., StudentT instead

of Normal) - Under-dispersed: Use NegativeBinomial instead of Poisson

- Wrong central tendency: Check likelihood specification

- Systematic bias: Missing predictors or wrong functional form

- Overlay histogram/density of observed vs simulated

- Time series overlay (if data is temporal)

- Also: Check coverage: what % of observed points fall inside 50% / 90%

predictive intervals?

MARKETING PPC EXAMPLES

Example 1: Daily Visitor Model

- Check: Can model generate both typical days (400-600) AND peak days

(1500+)? - Check: Does model capture day-of-week effects if present?

- Check: Are 90% of observed days within model's 90% predictive interval?

Example 2: Conversion Rate Model

- Check: Does model predict rates consistent with historical performance?

- Check: Can model capture variation between channels?

- Check: Does model handle campaigns with very few conversions?

Example 3: Email Campaign Performance

- Check: Does model reproduce observed open rates across campaigns?

- Check: Can model handle campaigns with high engagement (15%+) and low

engagement (2%)? - Check: Does model account for list fatigue over time?

PERFORMANCE OPTIMIZATION

PREFER NUMPYRO NUTS WHEN AVAILABLE

Setup:

from pymc.sampling.jax import sample_numpyro_nuts

import osSet cache directories to avoid permission issues

os.environ['MPLCONFIGDIR'] = '.matplotlib_cache'

os.environ['PYTENSOR_FLAGS'] = 'compiledir=.pytensor_cache'

Sampling Parameters:

- draws: ≥ 400 (1000+ recommended)

- tune: ≥ 400 (1000+ recommended)

- chains: ≥ 4

- target_accept: 0.9 (0.95 for difficult geometries)

- chain_method: "parallel"

ADVANTAGES OF NUMPYRO NUTS

- No C++ compilation issues (uses JAX backend)

- More efficient than Metropolis-Hastings

- Better automatic adaptation and tuning

- Proper convergence with multiple chains

- GPU acceleration available

- Faster execution overall

FALLBACK STRATEGY

- First choice: NumPyro NUTS with full data

- If unavailable: PyMC NUTS with reduced draws/tune

- Ensure: PyMC version exposes pymc.sampling.jax

- Warning: PyMC NUTS is slower than NumPyro

SAMPLING BEST PRACTICES

- Use full dataset (don't subset for speed)

- Run minimum 400 draws + 400 tune with 4 chains

- Watch diagnostics: R-hat ≤ 1.01, ESS high, divergences = 0

- Rerun with more draws/chains if thresholds not met

- Select draws/tune/chains to ensure valid fit

MODEL COMPARISON

LEAVE-ONE-OUT CROSS-VALIDATION (LOO)

What to check:

- ELPD_LOO (EXPECTED LOG POINTWISE PREDICTIVE DENSITY)

- Higher (less negative) is better

- Difference > 10 is meaningful

- Measures out-of-sample predictive accuracy

- P_LOO (EFFECTIVE NUMBER OF PARAMETERS)

- Should be close to actual parameter count

- Very large values indicate overfitting or missing noise term

- Unusually high = model forcing structure on data

- PARETO-K DIAGNOSTIC

- Must be < 0.7 for reliable results

- k > 0.7 means LOO estimates are unreliable

- Action if k > 0.7: Fix model before trusting results

RULES OF THUMB

- Large elpd_loo difference (>10) = meaningful improvement

Consider Δelpd relative to its SE (if Δelpd is small vs SE, don't

overclaim) - p_loo unusually high = model complexity warning

p_loo is an effective complexity measure; unusually high values can

indicate overfitting, weak priors, or a missing noise term - Any Pareto-k > 0.7 = results unreliable

MARKETING EXAMPLE: COMPARING CAMPAIGN MODELS

Model A: Simple Poisson for daily leads

- elpd_loo = -850.2

- p_loo = 2.1 (close to 2 parameters)

- Pareto-k: all < 0.5 (good)

Model B: NegativeBinomial with channel effects

- elpd_loo = -825.7

- p_loo = 5.3 (close to 5 parameters)

- Pareto-k: all < 0.6 (good)

Conclusion: Model B is better (elpd_loo difference = 24.5 >> 10)

The extra complexity is justified by improved predictions

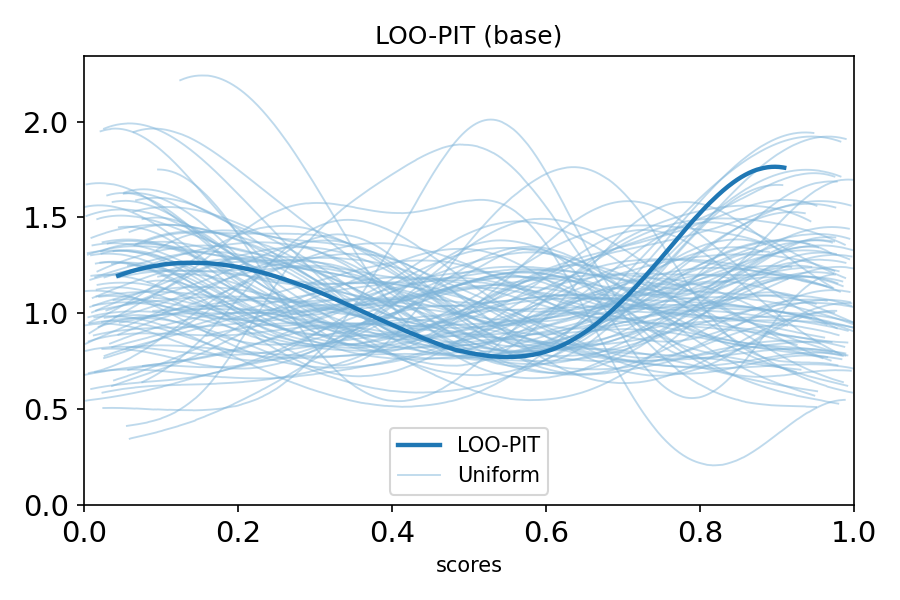

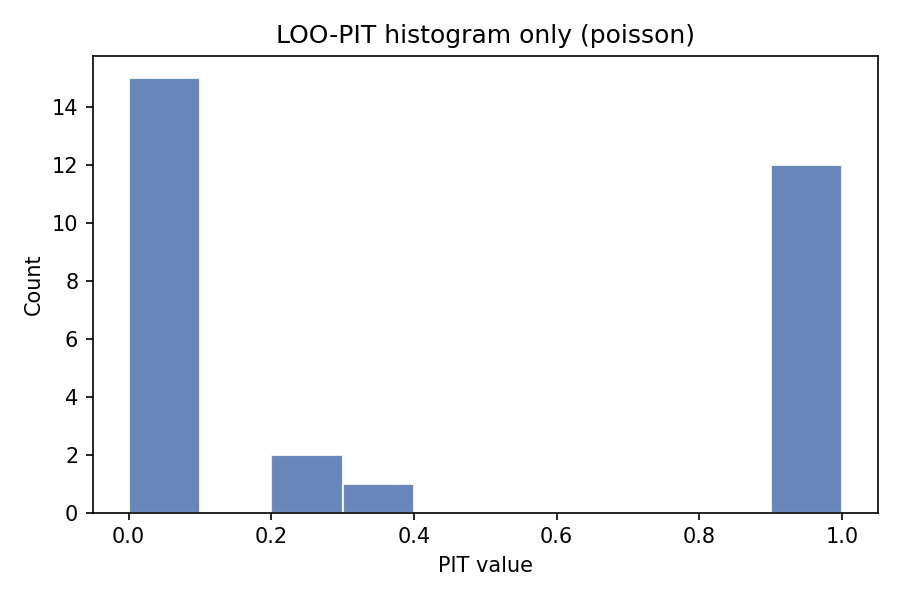

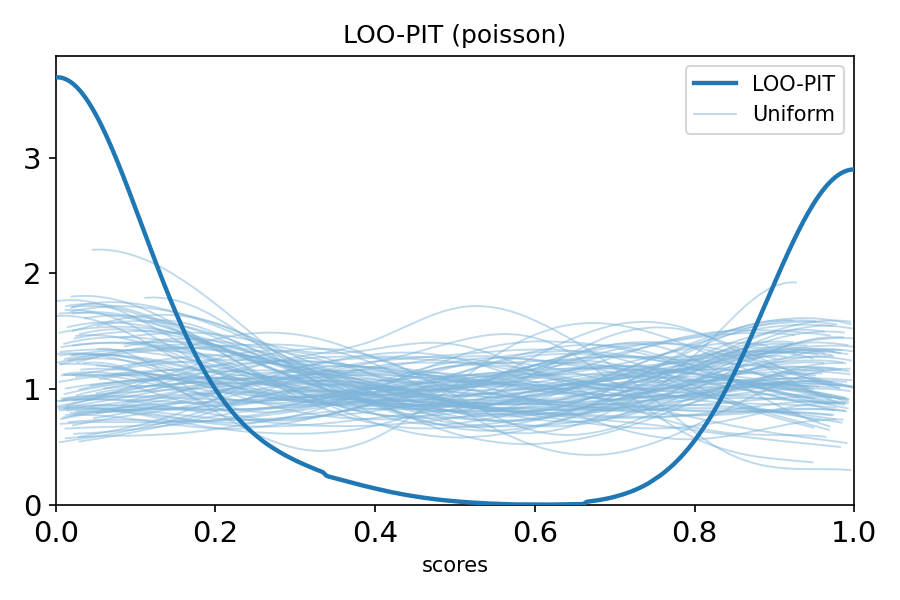

LOO-PIT (PROBABILITY INTEGRAL TRANSFORM)

Purpose: Check whether your model has realistic uncertainty

What it checks:

- Does model predict unseen data well?

- Is model over-confident or under-confident?

- Are predictions properly calibrated?

Interpretation:

- Uniform distribution = well-calibrated

- U-shaped = over-confident (intervals too narrow)

- Inverse-U = under-confident (intervals too wide)

WAIC (WIDELY APPLICABLE INFORMATION CRITERION)

When to use:

- Alternative to LOO when log-likelihood is available

- Compute: az.waic(idata)

- Compare elpd_waic: higher (less negative) is better

Warnings:

- If var(log p) > 0.4, WAIC may be unreliable

- Prefer LOO if WAIC shows warnings

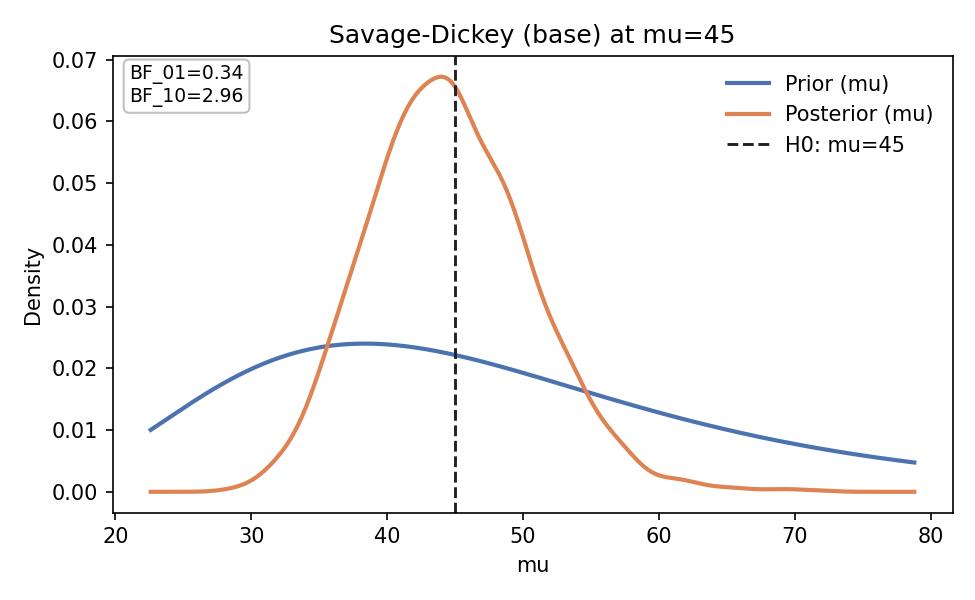

SAVAGE-DICKEY BAYES FACTOR

Use case: Testing point-null hypothesis in nested models

Requirements:

- Proper priors (not improper)

- Nested model structure

- Testing specific parameter value

Computation:

BF_01 = prior_density(theta=0) / posterior_density(theta=0)

Interpretation:

- BF ~ 1: Weak evidence

- BF 3-10: Moderate evidence

- BF > 10: Strong evidence

- BF < 1/3: Evidence against null

Marketing Example:

Testing if paid search has zero effect on conversions

- If BF_01 > 10: Strong evidence of no effect

- If BF_01 < 1/3: Strong evidence of positive effect

COMPLETE DIAGNOSTIC CHECKLIST

Use this checklist for every model:

BEFORE FITTING

[ ] Data sanity check completed

[ ] Distribution matches data constraints

[ ] Priors specified with justification

[ ] Prior predictive check shows reasonable values

[ ] Parameterization verified (mu, alpha, sigma meanings)

DURING FITTING

[ ] Used NumPyro NUTS if available

[ ] Set appropriate draws/tune/chains

[ ] Cache directories configured

[ ] Sampling completed without errors

AFTER FITTING (CONVERGENCE)

[ ] R-hat ≤ 1.01 for all parameters

[ ] ESS > 100 (preferably hundreds+) for all parameters

[ ] Divergences = 0

[ ] Trace plots show good mixing

[ ] Rank plots show uniform distribution

[ ] Chains converge to same distribution

VALIDATION

[ ] Posterior predictive check performed

[ ] PPC shows model reproduces observed data

[ ] PPC covers central tendency, spread, and tails

[ ] LOO computed and Pareto-k < 0.7

[ ] LOO-PIT shows proper calibration

[ ] WAIC computed if appropriate

MODEL COMPARISON (IF APPLICABLE)

[ ] Compared to simpler baseline model

[ ] elpd_loo differences computed

[ ] p_loo values reasonable

[ ] Best model selected with justification

REPORTING

[ ] Report full credible intervals (not just point estimates)

[ ] Acknowledge uncertainty

[ ] Document prior choices

[ ] Note any model limitations

[ ] Avoid over-interpreting results

WARNING SIGNS & FIXES

BAD CHAINS (SYMPTOMS)

- Chains sit in different bands

- Chains drift over time

- Distinct KDEs for different chains

- High R-hat values

Why this happens:

- Multimodal posterior

- Poor geometry (funnel, high correlation)

- Misspecified priors/likelihood

- Weak identifiability

- Insufficient tuning/draws

- Too-low target_accept

Fixes:

- Increase draws and tuning steps

- Increase target_accept to 0.95 or 0.99

- Reparameterize (try non-centered parameterization)

- Simplify model structure

- Check prior specification

IMPORTANT REMINDER: GOOD CHAINS ≠ GOOD MODEL

Even with R-hat ~ 1.00 and zero divergences, your model can still be wrong if:

- PPC fails (model can't reproduce data)

- Wrong likelihood chosen

- Missing important predictors

- Incorrect functional form

Always validate with posterior predictive checks!

- If prior predictive is implausible → stop

- If posterior predictive misses key features (variance, tails,

seasonality) → stop

THE BIG PICTURE (ELI5)

Think of PyMC like this:

- WRITE YOUR GUESS (story about the world)

What kind of data-generating process makes sense?Marketing Example: "I think conversion rate is around 3-5% with some

variation by channel" - CHECK IF IT'S SILLY (before looking at data)

Would your guess make reasonable fake data?Example: Does your prior generate conversion rates between 0-20%?

(Reasonable) or between -10% to 150%? (Silly!) - UPDATE YOUR GUESS (using real data)

Let the data teach you what actually fitsExample: Data shows organic channel converts at 7%, paid at 2.5% - TEST IF IT WORKS (generate fake data and compare)

Can your updated guess make data like the real thing?Example: Can your model generate both high-converting days and

low-converting days?

THE MAGIC

- Starts with your guess (priors)

- Looks at real data (likelihood)

- Updates to what actually fits (posterior)

- Maybe it learns something new!

GOLDEN RULES

- Follow the 4-stage workflow

Design → Check Priors → Fit → Validate. No shortcuts. - Match distributions to data constraints

Count data needs count distributions, not Normal. - Let the model learn variance

Never fix sigma unless you have very strong domain knowledge. - Always validate

If posterior predictions don't match observed data, your model is wrong. - Never ignore convergence warnings

Divergences and high R-hat mean invalid inference. - Check parameterization

Always verify parameter meanings before sampling. - Use domain knowledge

Set realistic priors based on subject matter expertise. - Report uncertainty

Always include credible intervals, never just point estimates. - Compare alternatives

Try simpler baseline model first (e.g., Poisson before

NegativeBinomial). - Interpret with humility

Don't over-interpret single point estimates. Acknowledge limitations.

MARKETING-SPECIFIC MODELING SCENARIOS

SCENARIO 1: WEBSITE TRAFFIC MODELING

Business Question: What's our expected daily traffic next month?

Data Characteristics:

- Whole number counts (visitors per day)

- Likely overdispersed (weekends differ from weekdays)

- Possible seasonality

Recommended Approach:

- Distribution: NegativeBinomial (handles overdispersion)

- Priors:

- mu ~ Normal(current_avg, current_std)

- alpha ~ Exponential(0.1) for overdispersion

- Add day-of-week effects if needed

- Validate: Can model reproduce both slow days and peak days?

Red Flags:

- Poisson under-fits if weekday/weekend variance is high

- Check PPC for tail coverage

SCENARIO 2: A/B TEST FOR CONVERSION RATE

Business Question: Is new landing page better than control?

Data Characteristics:

- Binary outcomes (converted: yes/no)

- Two groups to compare

- Need probabilistic statement about difference

Recommended Approach:

- Distribution: Binomial(n, p) for each variant

- Priors: Beta(2, 50) for both p_control and p_treatment (weak prior ~4%)

- Compare posteriors: P(p_treatment > p_control)

- Report: Full credible interval for difference

Red Flags:

- Don't just report "treatment won" - report probability and magnitude

- Check if difference is practically significant (not just statistically)

SCENARIO 3: CUSTOMER LIFETIME VALUE (CLV)

Business Question: What's the expected revenue per customer?

Data Characteristics:

- Positive continuous (revenue can't be negative)

- Often right-skewed (most customers spend little, few spend a lot)

- May have high variance

Recommended Approach:

- Distribution: LogNormal or Gamma

- Priors:

- LogNormal: mu ~ Normal(log(historical_avg), 0.5)

- sigma ~ HalfNormal(1)

- Consider segment-specific models (new vs returning)

- Validate: Can model generate both typical and high-value customers?

Red Flags:

- Normal distribution will predict negative CLV (impossible!)

- Check if tails are well-modeled in PPC

SCENARIO 4: CAMPAIGN PERFORMANCE ACROSS CHANNELS

Business Question: Which channels perform best for lead generation?

Data Characteristics:

- Count data (leads per campaign)

- Multiple groups (channels)

- Likely different variances per channel

Recommended Approach:

- Distribution: NegativeBinomial (channel-specific)

- Hierarchical structure:

- Overall mean across channels

- Channel-specific deviations

- Priors: Weakly informative based on historical channel performance

- Validate: Model should capture both high-performing and low-performing

campaigns

Red Flags:

- Don't assume all channels have same variance

- Check if model handles channels with very few campaigns

SCENARIO 5: EMAIL CAMPAIGN OPEN RATES

Business Question: What's our true open rate, accounting for uncertainty?

Data Characteristics:

- Rate/percentage (bounded 0-1)

- Multiple campaigns to aggregate

- Want credible interval, not just point estimate

Recommended Approach:

- Distribution: Beta-Binomial (for each campaign)

- Hierarchical model:

- Overall open rate (Beta prior)

- Campaign-specific variation

- Priors: Beta(10, 90) suggests ~10% with moderate confidence

- Validate: Does model handle both high-engagement and low-engagement

campaigns?

Red Flags:

- Point estimate hides uncertainty - always report full posterior

- Check if list fatigue (declining open rates over time) needs modeling

SCENARIO 6: TIME TO CONVERSION

Business Question: How long until leads convert to customers?

Data Characteristics:

- Positive continuous (days/hours)

- Right-skewed (most convert quickly, some take long)

- May have censoring (leads that haven't converted yet)

Recommended Approach:

- Distribution: LogNormal or Weibull

- Consider survival analysis if censoring is important

- Priors:

- LogNormal: mu ~ Normal(log(7), 1) if median is ~7 days

- sigma ~ HalfNormal(1)

- Validate: Can model generate both quick conversions (1 day) and slow

conversions (60+ days)?

Red Flags:

- Exponential assumes constant hazard (may be unrealistic)

- Check if there are distinct "fast" and "slow" converter populations

PRACTICAL TIPS FOR MARKETING ANALYSTS

- START SIMPLE, ADD COMPLEXITY AS NEEDED

- Begin with basic model (e.g., Poisson for counts)

- Add overdispersion if needed (NegativeBinomial)

- Add predictors only if they improve LOO significantly

- USE HISTORICAL DATA TO INFORM PRIORS

- If average conversion rate is 3-5% historically, use Beta(3, 97) prior

- If daily traffic averages 500, center prior around mu=500

- Don't use uninformative priors when you have domain knowledge

- THINK IN TERMS OF DATA-GENERATING PROCESSES

- How does the world generate this data?

- What constraints must be respected?

- What sources of variation exist?

- VALIDATE AGAINST BUSINESS INTUITION

- Does predicted conversion rate match your experience?

- Are forecasts reasonable given market conditions?

- Can stakeholders understand and trust your uncertainty estimates?

- COMMUNICATE UNCERTAINTY CLEARLY

- Report: "Conversion rate is 3.2% [95% CI: 2.8-3.6%]"

- Not: "Conversion rate is 3.2%"

- Show stakeholders the full posterior distribution when possible

- COMPARE TO FREQUENTIST BENCHMARKS

- Run traditional t-tests or proportion tests as sanity checks

- Bayesian results should be in same ballpark (if using weak priors)

- If very different, understand why

- DOCUMENT YOUR MODELING CHOICES

- Why this distribution?

- Why these priors?

- What assumptions are made?

- What are the limitations?

- ITERATE AND IMPROVE

- First model is rarely final model

- Use PPC to identify weaknesses

- Add complexity only when justified by data

FINAL WORDS:

Bayesian analysis is powerful but requires discipline. Every shortcut risks

invalid inference. Follow this guide systematically, and you'll build

reliable models that produce trustworthy results.

WHEN IN DOUBT:

- Check your data first

- Pick the right "number-making machine"

- Make a reasonable starting guess

- Test the machine before and after training

- If the machine can't copy real data, fix it

- Always verify parameter meanings

REMEMBER: A model that passes all diagnostics can still be wrong if it fails

posterior predictive checks. Validation is not optional.

Good luck with your analyses!

BAYESIAN QUICK REFERENCE CARD

WORKFLOW CHECKLIST:

[ ] 1. Sanity check data

[ ] 2. Choose distribution matching data type

[ ] 3. Set informative priors from domain knowledge

[ ] 4. Prior predictive check (before fitting)

[ ] 5. Fit with NumPyro NUTS (draws≥400, chains≥4)

[ ] 6. Check R-hat≤1.01, ESS>100, divergences=0

[ ] 7. Posterior predictive check (after fitting)

[ ] 8. Compare models with LOO if needed

[ ] 9. Report full uncertainty (credible intervals)

[ ] 10. Document all choices and limitations

CONVERGENCE TARGETS:

- R-hat: ≤ 1.01

- ESS: Hundreds+ (minimum 100)

- Divergences: 0

- Pareto-k: < 0.7

DISTRIBUTION QUICK REFERENCE:

- Daily visitors (counts): NegativeBinomial

- Conversion rate (0-1): Beta

- Time to convert (positive): LogNormal

- Yes/no conversion: Binomial

- Revenue difference: Normal

- Overdispersed counts: NegativeBinomial

WHEN MODEL FAILS:

- Check prior predictive (silly priors?)

- Check convergence (bad chains?)

- Check posterior predictive (wrong likelihood?)

- Simplify or reparameterize

- Try different distribution family

REPORTING TEMPLATE:

"We estimate [parameter] is [point estimate] with 95% credible interval

[lower, upper]. This means there's a 95% probability the true value lies

in this range, given our model and data. Key assumptions: [list].

Limitations: [list]."

For questions, updates, or feedback on this guide, consult:

PyMC documentation: https://www.pymc.io/

PyMC Discourse: https://discourse.pymc.io/

ArviZ documentation: https://arviz-devs.github.io/

This guide is a living document. Update as you learn new best practices.